By Ming Lianto, Senior Insights Manager, Shopper Intelligence ANZ

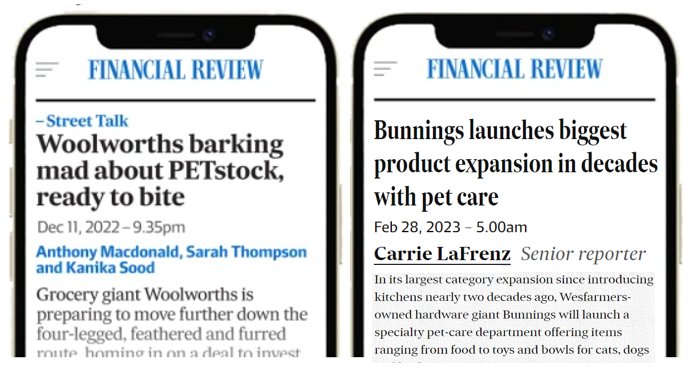

The last quarter’s seen the pet sector appear in the news a few times – with both Woolworths Group & Wesfarmers moving in to get a share of the pie.

They’re right – it’s a lucrative market. And from a shopper’s standpoint, big growth potentials to be realised. Our shopper program surveyed over 60,000 Australian shoppers across bricks & clicks in the last year, and Pet category shoppers have told us about their big spend motivations that retailers and suppliers can capitalize on. They’ve also told us what improvement opportunities we can work on to improve their shopping experience and keep them in your brand, or your store.

Here are 3 things shoppers have expressed about the current pet market…

Pet shoppers are one of the most motivated to put more in their basket – and through multiple ways:

- They’re often persuaded to buy extra, e.g. by special offers

- They’re open to buying an additional item because they wanted to try something new or different

- They’re willing to pay more for better quality / something different

What does this mean?

If we pull the right levers, we can drive more spend in the department. Here are some examples: tempting volume trade up through bigger pack sizes or multibuys; inspiring and exciting through ‘new’ and more NPD; dialling up quality cues, showcasing premium and higher tier.

The next step would be going to category level and see what is most likely to work best for Cat Food, Dog Food, Pet Treats, etc.

Pet shoppers of Coles/WW Bricks stores are currently not very satisfied. Actually, Cat Food shoppers are one of the least happy out of the total store.

The biggest issue for them is that they really don’t want to run out of the category, but availability is not consistent enough for them. The shelf layout is also not as good as they’d like it to be.

What does this mean?

There are improvement opportunities for the department, and potential growth to be realised.

Pet products are very much a cupboard staple for shoppers, so prompt them pre-store to stock up on the category. But also, focus on their in-store journey: make sure the most popular SKUs are in-stock and easy to spot.

It is also in the retailers’ best interest to spotlight key brands & products as it will keep shoppers inside their store. Pet categories are a destination shop for shoppers – it is the main reason they go shopping – so if their usual choice is not available, they are very likely to go to another store.

Online pet shoppers are even less satisfied – less so than their bricks counterparts, but also less so than the average online shopper.

Online availability is also their biggest demand: “Ensure the specific product I want is available – I don’t want a replacement.” There is work to be done to fix availability issues across channels, and a focus to improve visibility online: being front and top of page.

Pet shoppers are also not in the same mindset online as when they’re shopping in store. Online is really an avenue of convenience and comfort for them – a highly planned, regular purchase – less so for trading up. They’re searching directly for what they need and putting it in their cart. So, for now, the focus here is getting the core product range right and communicating clear value.

What does this mean?

Invest in real-time stock capabilities, as well as auto-refill or re-order functionalities. Make sure your SEO is right for how shoppers search for your products and optimize your images so shoppers can easily find what they’re looking for.

About Ming Lianto

Ming has been with Shopper Intelligence for three years and is passionate about storytelling with data. She is a Shopper & Ecomm expert, combining this with her marketing and category experience from previous roles at Nestle and Diageo.

She is also a big shopper of the pet sector – with 4 big pups of her own.

This article was originally published in Retail World Magazine and reposted here with permission