By David Shukri, Australian Client Service Director

By David Shukri, Australian Client Service Director

Be the change your liquor off-premise shoppers want to see!

If you’ve spent much time out in the field in the liquor off-premise in recent months, you’ve probably noticed one thing in particular.

Change.

Change in categories. Change in range. Change in space allocations.

Not to mention the change you can’t see at the shelf edge, as cost pressures continue to impact the economics of the liquor store and its products.

And with these changes, retailers are crying out for a more rounded, less introspective vision from their suppliers. More and more people in the industry are realising just how important it is to incorporate and embed shopper behaviours into their liquor off-premise strategy.

A strategy that blends key shopper insights with keen consumer knowledge results in a more effective approach to the big challenges the market faces.

So, what are those big challenges from a shopper’s point of view?

Our annual survey of more than 20,000 liquor shoppers is always on hand to give you the clues you need.

That don’t impress me much!

Few men took Shania Twain all that seriously when she listed her complaints against them in the late 90’s. In 2023, we should all sit up and pay attention to what female shoppers are telling us about the off-premise liquor channel.

Specifically, they’re not that impressed either, or not as impressed as they were.

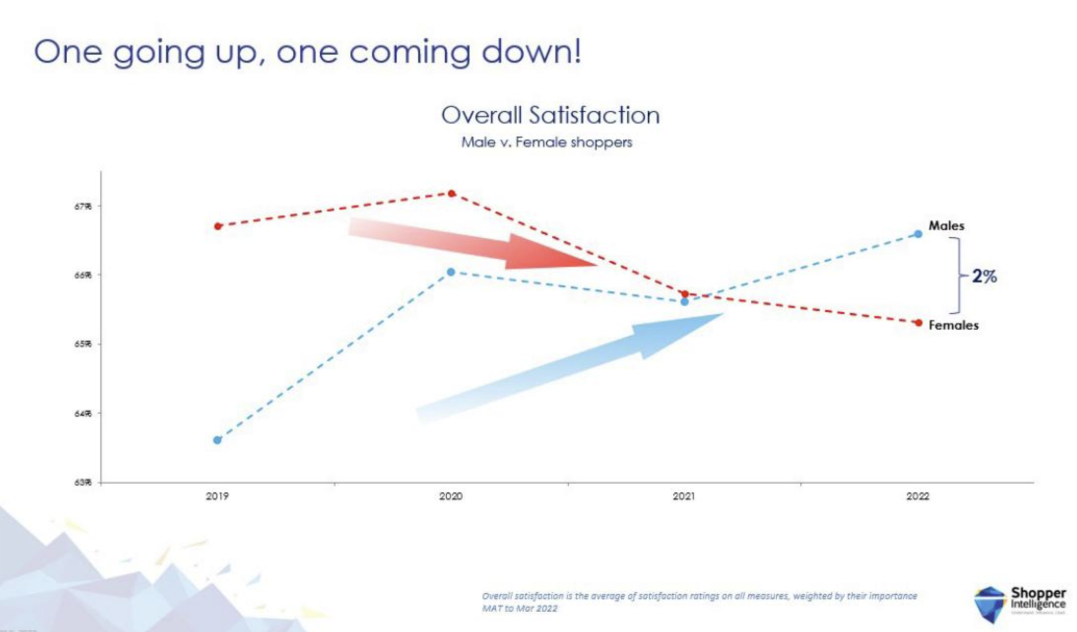

Go back to 2019 and you’ll find it was female shoppers who registered higher overall satisfaction (which is the average of satisfaction ratings on all 16 measures tracked by Shopper Intelligence, weighted by their importance) in the channel when compared to males.

Today, the situation is inverted and the score from females has been dropping since 2020.

Males now record a score of 67%, compared with 65% among females. Doesn’t look catastrophic on paper, but the direction of travel does make this worth exploring in more detail.

The precise root of their dissatisfaction differs category by category. In wine, females have greater concerns about product authenticity and availability than their male counterparts.

In spirits on the other hand, the biggest satisfaction gaps lie in areas like the enjoyment of the shopping experience and availability of different pack types to suit their needs.

The bottom line is this is a meaningful and, I’d argue, concerning trend. Only cider sees females out-scoring males on overall satisfaction. So, wherever you are in the store, there’s something here to think about.

Young and gloomy

I heard an industry leader say last year,

“Gen Z are the future for us.”

If that’s the case, there’s more to do with this cohort, because our research shows they’re the least satisfied age group in off-prem liquor.

18 to 24-year-olds are much less content than the average liquor shopper, with overall satisfaction of just 59%.

In wine that drop to 55%, but perhaps more worryingly in RTD categories, the figure is only 53%!

This is really eye-opening considering the array of sweeter flavour-profile drinks winning space right now and the marketing dollars behind them.

Now, this is where shopper insights come to the fore and shed light on what’s going on.

When they shop, these guys are in fact pretty happy with the products they’re buying. New product innovations are important to them and broadly speaking, they feel they’re getting what they want.

What’s not floating their boat is some of the practical aspects of liquor shopping. Layouts of both stores and shelves, plus perceptions around availability, are causing headaches.

Why?

Because younger shoppers are far more likely to buy for a specific occasion and for immediate consumption.

One in two buys with a particular occasion in mind and eight in ten intend to consume the same day.

For context, only one in three over 55s plan to drink what they buy on the day they buy it.

In general, the traditional way stores are set up and navigated just doesn’t serve those needs as well as they could.

Time for some deep thought if our industry is serious about evolving and putting the young shopper at its core.

No/lo has potential but work to do

I want to finish on a positive by calling out the huge opportunity for our industry in the reduced alcohol space, if we can get it right.

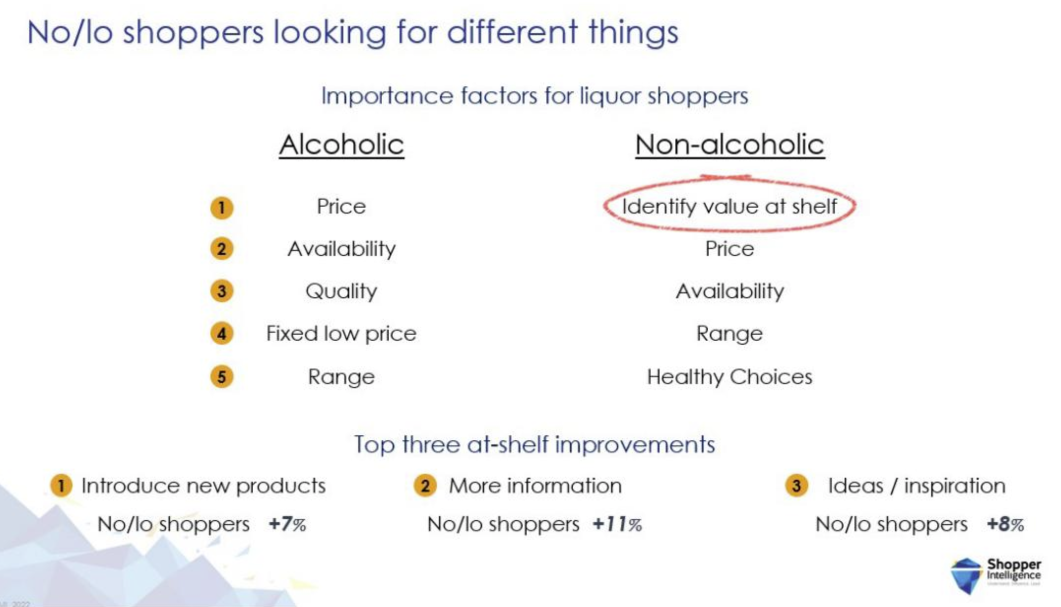

I say that because we know conclusively that this shopper is not the same as the traditional liquor shopper.

Their shopping motivations and behaviours are different, so they demand a distinct strategy.

As an example, their most critical importance factor is not price, as it is for traditional alcohol shoppers. In fact, it is the ability to identify value at shelf.

That’s not all. Innovation, information, promotions and pre-store comms are all much more critical if you want to engage the no-alc shopper.

Businesses this year will need to ask how seriously they want take the no-alc opportunity. The answer to that will determine how much time they invest in understanding this shopper.

These are just three of the areas of change Shopper Intelligence has identified in the last twelve months.

If you want to partner with your retailers more effectively and show them you can adapt to change, now’s the time to act.

Don’t cut and paste, don’t go with black-and-white strategies.

Get under the skin of the specific dynamics, behaviours and motivators that drive shoppers in your category.

That’s one way to make change work for you this year.

If you want to get insights on shoppers in your category, contact the team today.

This article was originally published in National Liquor News and reposted here with permission.